Staking ETH on Lido

Key Takeaways:

- This strategy fits the profile of an investor who is willing to take on a little risk in exchange for a decent reward on ETH.

- The strategy is built on the top of Lido, the largest ETH staking protocol.

- The strategy is fairly simple: ETH are staked using the Lido protocol. At expiration, stETH (staked ETH) are unstaked and ETH is received back.

- The Yield (APY) is composed of staking of ETH on Lido

- Although unlikely, smart contract risk is not to be ignored: an exploit in Lido would impact the entire strategy (tech risk).

- The strategy can be exited at any time. A cooldown is present and rewards are paid out at the end of the period (in normal market conditions this is up to 5 days).

- Staking is subject to very specific risks, namely slashing. Lido is a trustable protocol (low slashing risk).

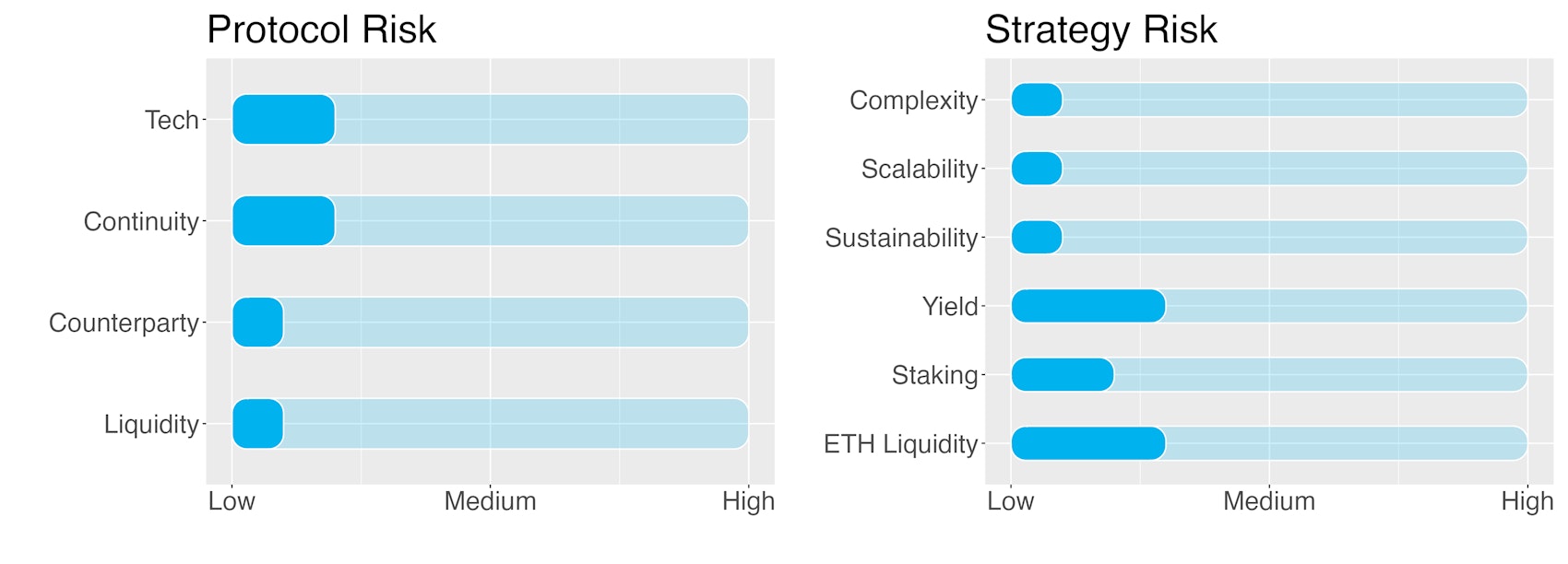

- Risk Checklist: in our view the predominant risks for this strategy are - Tech risk - ETH liquidity risk - Staking risks

1. Strategy Explained

The strategy stakes the ETH token in Lido Finance in return for stETH which then accrues the staking rewards.

Lockup period: None. A cooldown period is present. Its length depends on the exit queue.

2. Strategy Risks

Trust Score

Lido is a liquid staking solution for Ethereum. It allows users to deposit their tokens and take part in the Proof-of-Stake consensus mechanism via delegated staking. Currently, Lido supports the liquid staking of ETH, SOL and MATIC. In exchange for the provided tokens, the users receive a staked version, e.g. stETH for ETH. These can be used to earn an additional yield in the DeFi universe. Lido launched its staking app on December 19, 2020 with 1 billion LDO tokens created at genesis.

SwissBorg trust score for Lido is ‘green’, i.e. the protocol is trustable.

The score value is 8/10 signalling that Lido is one of the safest options out there.

Protocol Risks

Project Continuity Risk

Project continuity risk is low.

Lido is the leading protocol for liquid staking, displaying a staggering TVL of $13.8b (and a ATH of over $20b). In terms of valuation the token market capitalization to its TVL is close to 0, in

front of a median for the category of 0.16. Overall sentiment is medium.

Lido continuity risk is 2/10.

Counterparty Risk

Counterparty risk is deemed low.

Lido connects users wanting to stake e.g. ETH with node validators requiring ETH to perform the Proof-of-Stake mechanism. The process is regulated by a smart contact so there is no real counterparty credit risk on the Lido side. For the risk of slashing please refer to the relevant section below.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

The strategy can be exited at any time from Lido (although a cooldown period applies). Staked ETH (stETH) is redeemed at 1-1 value for ETH.

There hence no liquidity risk present.

Liquidity risk is 1/10.

Strategy Risks

Complexity

Complexity of strategy is low.

The strategy employs one chain (Ethereum), 1 protocol (Lido), and two tokens (ETH and stETH). Only one operation is involved: staking ETH (and unstaking it when exiting the strategy).

Complexity of the strategy is 1/10.

Scalability

Scalability risk of strategy is low.

Over 7,4 million ETH are currently staked in Lido (USD value of around 13.5b). Scalability is definitely not an issue with this strategy.

Scalability risk of the strategy is 1/10.

Sustainability

Sustainability risk of strategy is low.

The strategy generates yield via ETH staking in Lido. No incentives are present and the yield can therefore be considered as ‘real’.

Sustainability risk of the strategy is conservatively set to 1/10.

Yield Risk

Yield risk of strategy is low.

The APY from staking depends on the performance of Lido validators and can be affected by penalties or slashing (see below).

Since ‘the Merge’ (September 2022) the APY received for staking ETH in Lido has been constantly floating around 5% (with some peaks beyond 10%).

The risk of experiencing volatility in the APY is low.

Yield risk of the strategy is 3/10.

Lido Staking Risks

Lido staking risk is deemed low.

The Ethereum blockchain was initially built relying on a Proof-of-Work consensus mechanism, very similar to that of Bitcoin. It has switched on its Proof-of-Stake (PoS) mechanism in 2022 because it is more secure, less energy-intensive, and better for implementing new scaling solutions.

Ethereum PoS enables crypto investors to stake ETH in order to contribute to network security and decentralisation and earn an attractive yield for their staked tokens.

An important risk to be aware when staking ETH of is the possibility of losing your staked assets due to slashing. Slashing is a penalty enforced at the protocol level associated with a network or validator failure.

Liquid staking providers like Lido enable investors to participate indirectly in staking by delegating their tokens to a validator. Validators charge a fee for running a service for delegators. While delegators share rewards with their validators, they also share the risks of slashing. To minimise the risk of slashing, Lido stakes across multiple professional and reputable node operators with heterogeneous setups, with additional mitigation in the form of insurance that is paid from Lido fees.

Slashing risk for the strategy is 2/10.

Liquidity Risks of staking

Liquidity Risk on staking ETH is low.

Liquid staking on Lido comes with no lockup, only a cooldown period. In the presence of adverse market movements the investor would hence be able to promptly react - notwithstanding the cooldown period.

Liquidity risk is set to 3/10.

3. Conclusions/Recommendations

Lido is a liquid staking solution for Ethereum. It allows users to deposit their tokens and take part in the Proof-of-Stake consensus mechanism via delegated staking.

In terms of the user process, it’s good and smooth, with a helpful interface and a simple enough process to understand, and this removal of confusion is key in our book. When it comes to the ‘real’ APY, the yield currently provided to users comes from staking.

The Lido strategy in ETH comes with some risks. The investment strategy is fairly simple but yet it requires some understanding of how a PoS blockchain works and what are the risks of staking. It does not involve a locking period but in order to exit the strategy a cooldown period is required. Rewards are paid out daily.

The SwissBorg Risk Team ranks ETH on Lido as a Core investment, one for an investor with some understanding of DeFi and yielding, who is willing to take on little risk in exchange for a fair reward on ETH.