The last three months have been brutal in the crypto space. We have seen industry giants fall, violent liquidations, liquidity crunches, and Bitcoin closing the quarter at -56% from Q1's $45,000 close. Throughout previous market cycles, Bitcoin's all-time highs (ATHs) have served as support in a falling market. This played true until June 2022, when its price broke below 2017's ATH of $20,000.

It is not news that we are in a bear market, but the speed and veracity of this recent decline has undoubtedly caught investors by surprise.

June marked the transition from quantitative easing to quantitative tightening in the Federal Reserve's effort to curb inflation; the money printer went into reverse. Money flew out of the highest risk assets, with crypto at the top of the list being hardest hit. We expect to see an inflation peak some time in the near term. Still, inflation rates are not entirely within the Federal Reserve's control as the price of goods depends largely on supply chains greatly affected by the lockdowns in China and the Ukraine-Russia War. As profit margins compress, corporate profits in this second-quarter earnings season could cause market turbulence.

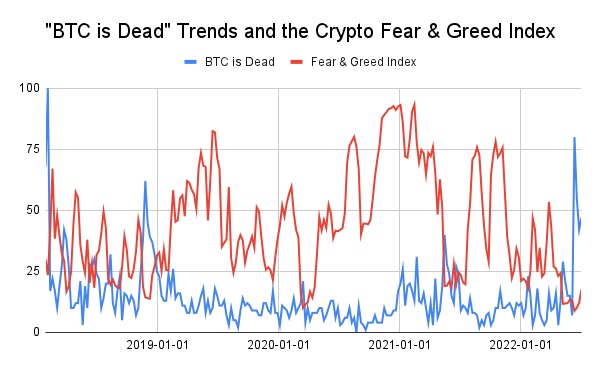

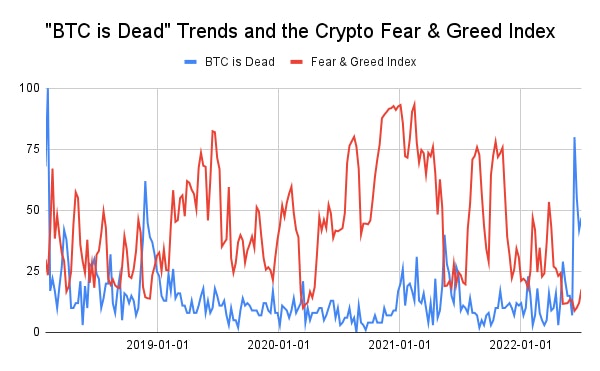

In an attempt to visualise market sentiment, the Crypto Fear and Greed Index shows levels reaching new lows (6; extreme fear). However, those in the know have heard the call of "crypto is dead" enough times to understand that this is a normal part of the crypto market cycle.

Macroeconomic factors and the unravelling of events have caused panic and forced selling. It is important to note that the crypto asset class has primarily existed in a near 0% US interest rate environment, and even though it was born out of a financial crisis of this scale, it has never gone through one. With this rationale in mind, investors should make decisions based on a broad set of metrics while reading the geopolitical situation and the directional change of monetary policy.

As The First Dominoes Fall, DeFi Works Flawlessly

Like banks, it is common practice for crypto institutions to use user-deposited cryptocurrencies to earn yield and share earnings with their users. For those institutions offering high yields, there are always equivalently high assumed risks.

Some of the institutions that promised high APY on stablecoins – by borrowing USD/USDT/USDC and depositing UST on Anchor Protocol – collapsed after the Luna-UST death spiral. Other institutions used user funds to accrue staked ETH (stETH), and when this token ‘de-pegged’, dropping in value against ETH, they could no longer honour their promised yields and withdrawals. Lastly, we saw the bust of a fund running a highly leveraged casino resulting in the bankruptcy of its lenders, some of whom had provided unsecured loans.

Due to a lack of transparency from the companies affected, the ripple effect of these events is yet to be seen. Even though we can assume there are more cadavers in the closet, the flush out of leverage is a positive step before the start of the next market cycle, and some would argue a necessary one.

These events came from human-operated and centralised platforms operating in ways that had nothing to do with the fundamentals of DeFi. DeFi protocols, such as Aave, Compound, and MakerDAO functioned flawlessly and effectively protected users. DeFi borrowing is over-collateralized with no restructuring ability, forcing CeFi companies to prioritise their DeFi loans and not have their collaterals liquidated.

As we see companies go bankrupt and users' funds evaporate, choosing the right custodians for your crypto and understanding where their yields come from is of utmost importance. This Darwinesque stress test will result in the 'survival of the fittest' and reward Ce-DeFi companies that follow best practices.

Inflation Has Not Peaked and the Fall of the Euro to $1 Parity

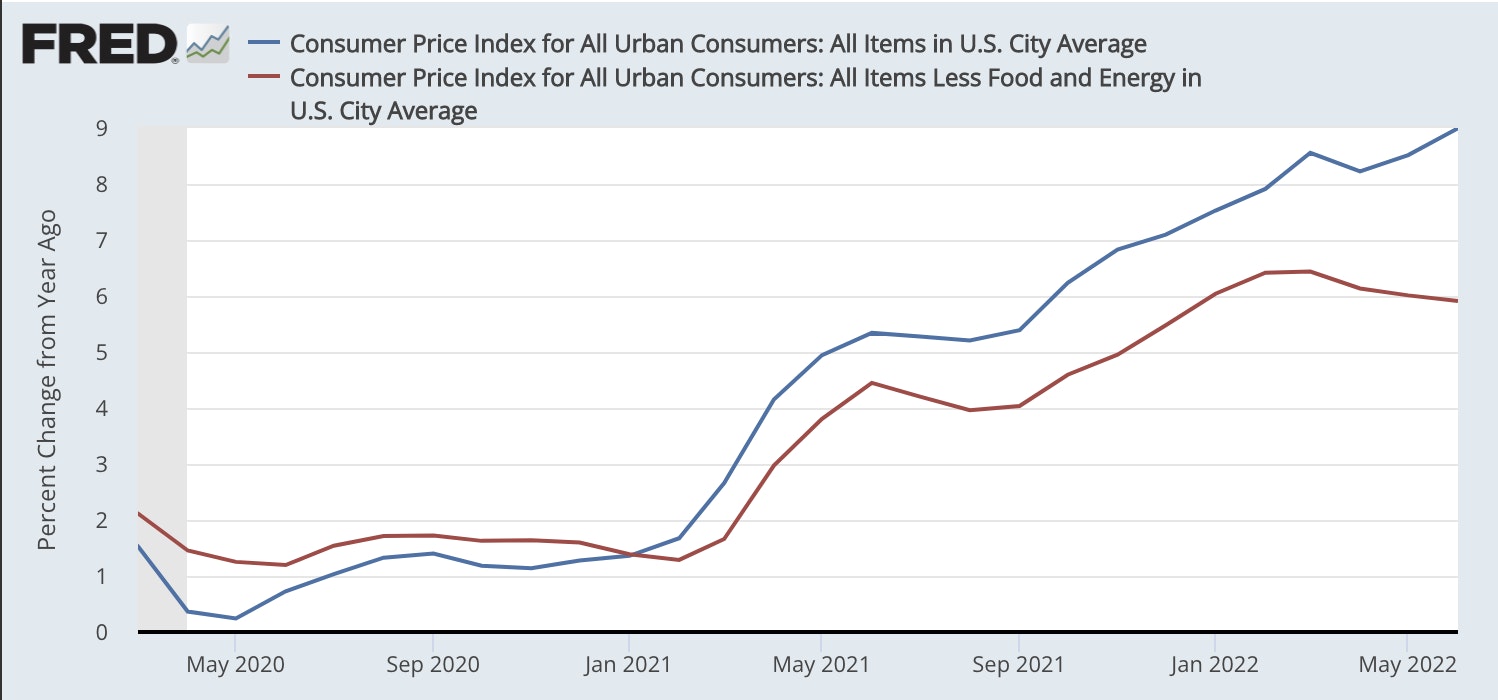

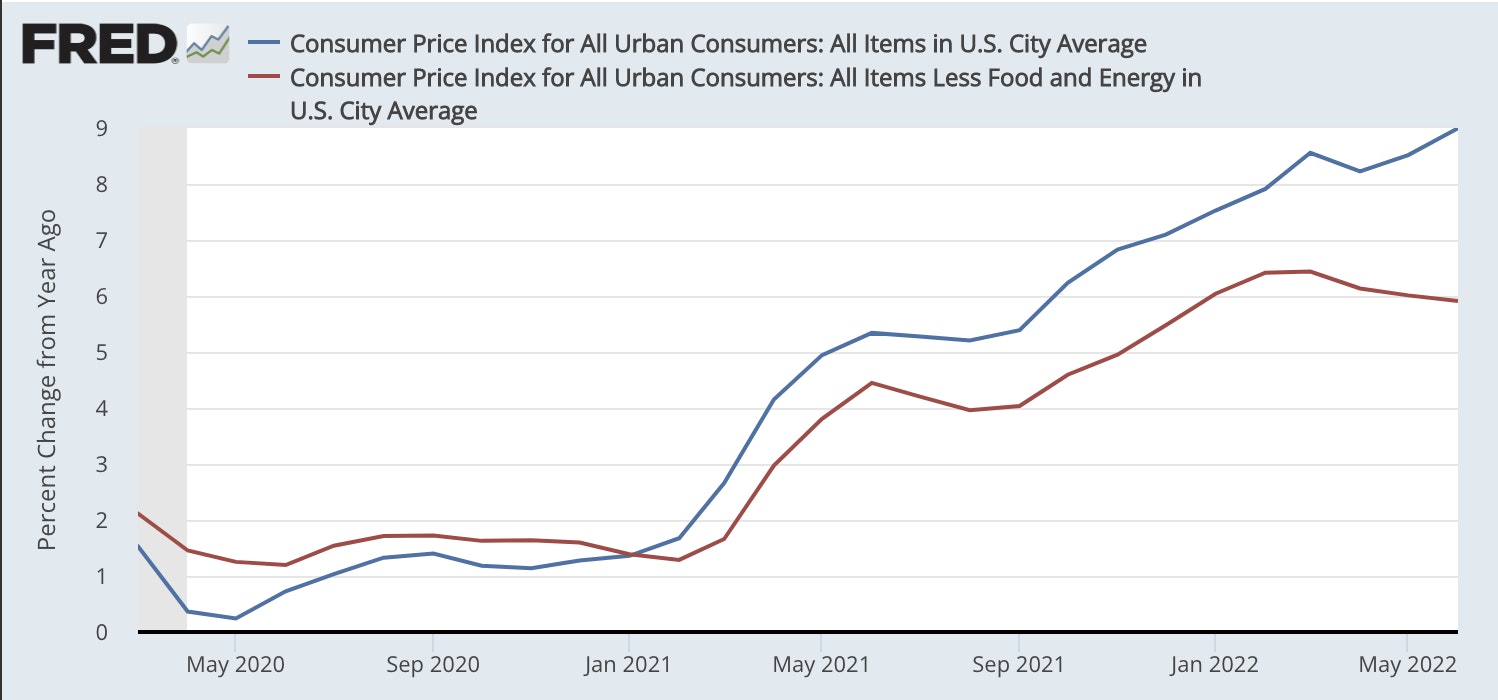

As long as inflation continues to rise, we cannot assume that the market has bottomed. The Consumer Price Index (CPI) year-over-year data for June 2022 came in at 9.1%, as the pressure builds for the Fed to more aggressively raise interest rates and restore price stability. Following the report, futures markets priced in the increasingly higher odds of a one percentage point increase in July.

As seen in the chart below, the increase in CPI comes mainly from the food and energy prices, which will likely continue to soar until the geopolitical issues resolve.

When looking at currency, the decline of the EUR/USD fiat currency pair seems to have stemmed from the European Central Bank lagging behind the Fed in tightening monetary policy. Recession fears, energy crisis threats, and rising inflation present fragmentation risks, where the impact of tightening would be harder on some countries of the European Union, namely Italy and Greece.

Psychologically, the EUR 1: USD 1 level is crucial, and a lower break would spur FX volatility that would spill into the crypto market. As capital continues rotating into safe havens like the U. S. Dollar and government bonds, the price of Bitcoin and other risky assets is pushed lower.

Even though the euro-pegged stablecoin has the second largest share of the currency pegged coins, it represents less than 1% of the total stablecoin supply. For this reason, a stress test from redemptions and volatility would likely not have a material impact on the total crypto market capitalization.

Bitcoin Miners’ Capitulation Begins

Unsurprisingly, the profitability of Bitcoin mining is plummeting. Lower BTC prices means the USD value of block rewards is lower. Increased energy prices make it difficult for miners to break even, forcing some to shut down their machines. The resulting lower operating cash flows mean miners must sell their BTC in the open market to stay afloat.

June saw the start of the 'capitulation event' where miners sold their Bitcoin holdings to cover the operational costs of servers, debts from existing and pre-ordered mining rigs, and a necessity to increase production capacity. Given the magnitude of the supply controlled by miners, a miners' capitulation event has historically marked the market bottom as it indicates the exhaustion of sell pressure.

Massive investment was made into Bitcoin mining expansion plans when it was a very profitable endeavour in November of 2021. As mining companies tend to collateralize debt with Bitcoin and mining hardware, machines and sites could soon go on a steep sale. It is well within the cards that distressed debt will likely also come to mining.

Bitcoin’s Historical Support Levels Become Resistance

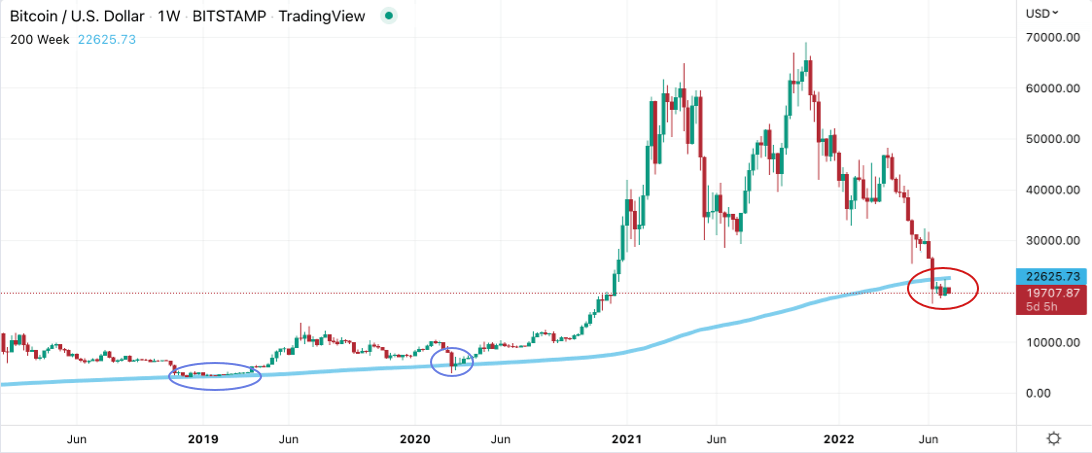

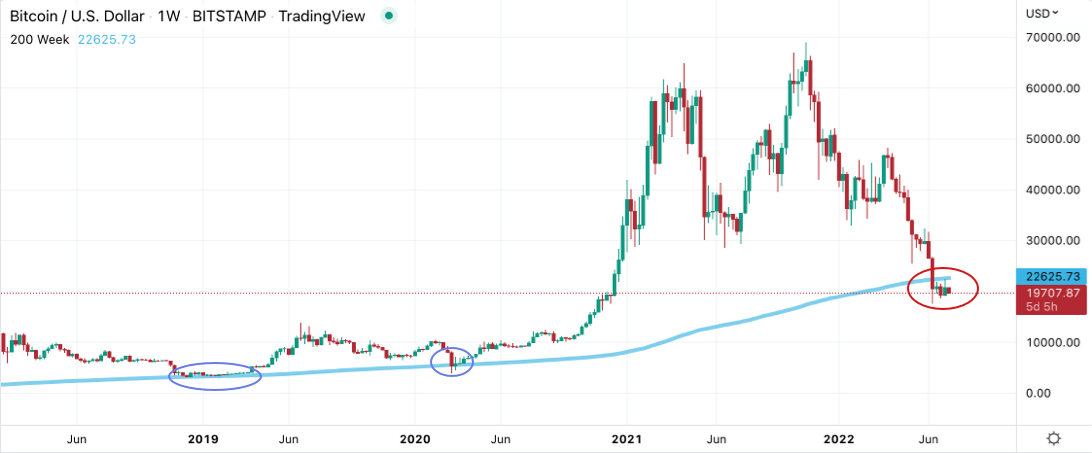

The 200-Week Simple-Moving-Average (SMA) (light blue line in the chart below) has been a trusted bottom indicator of bear markets. After proving not to be the end-all-be-all of support, these levels turned into resistance as we see Bitcoin trading below it for the fourth week in a row. Historically, times below the 200W SMA have been the best to accumulate Bitcoin.

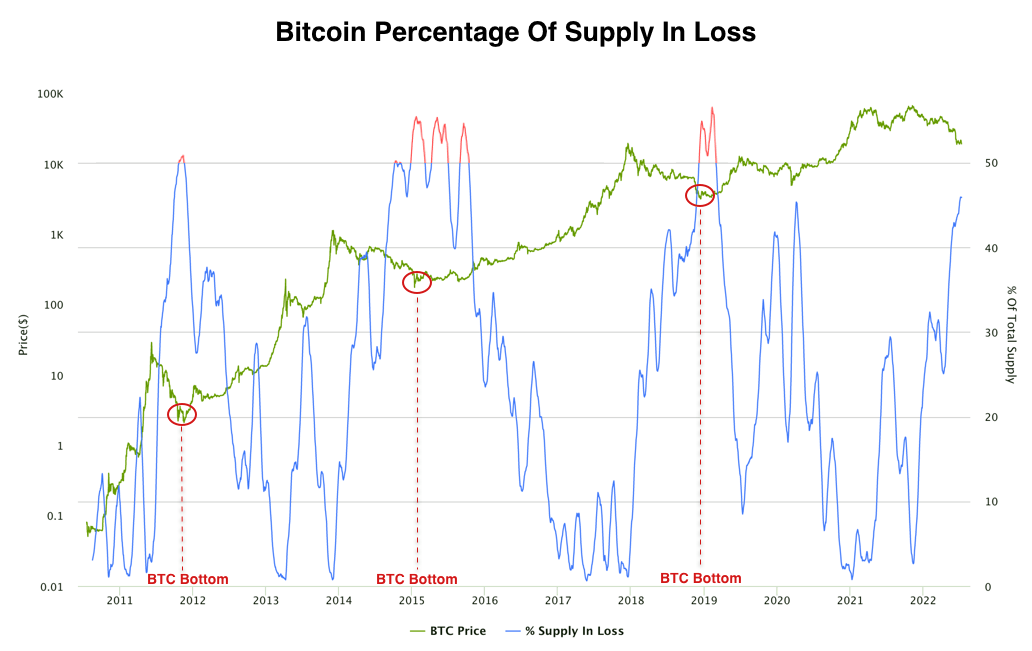

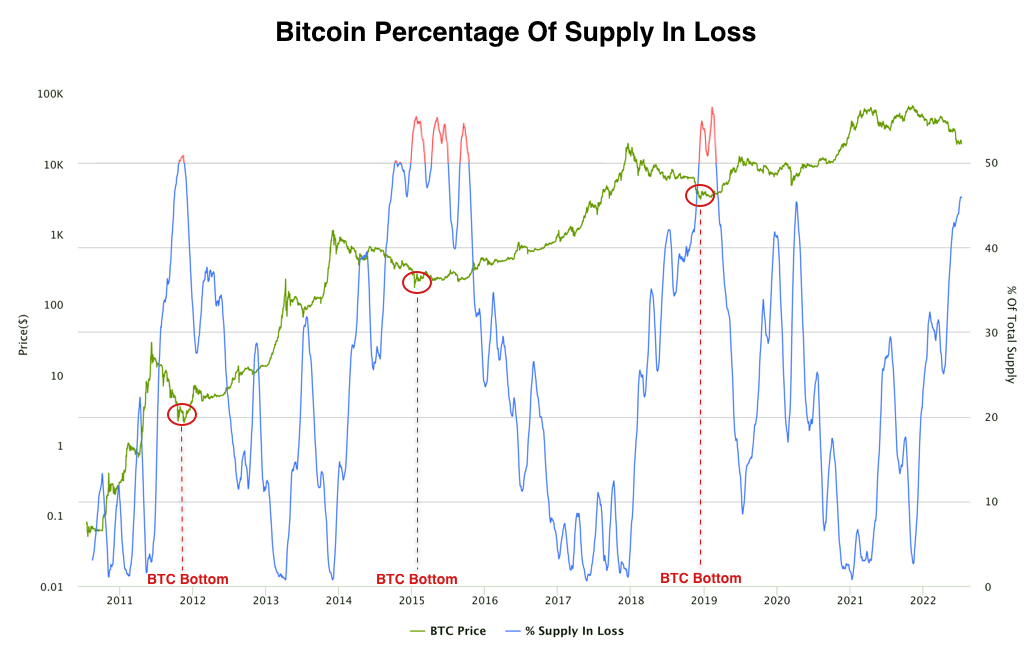

Although Technical indicators signal a possible market bottom, on-chain indicators show that, based on past behaviour, we are not there yet. The Bitcoin Percentage Supply in Loss shows that we have seen a trend reversal when the blue line turns red (chart below), more than 50% of the supply is at a loss, and holders refuse to sell.

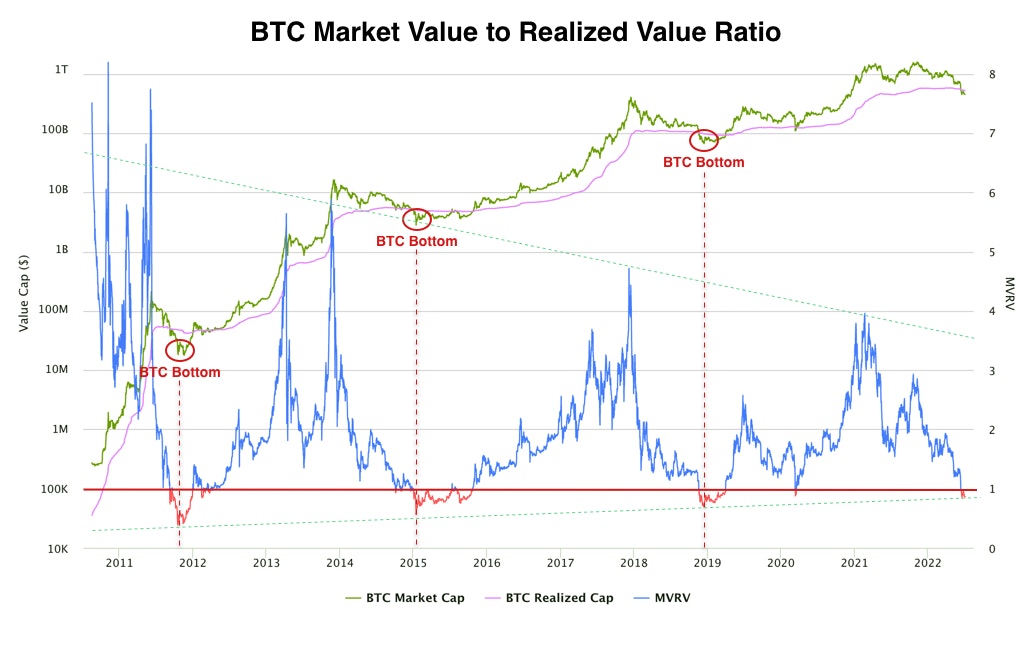

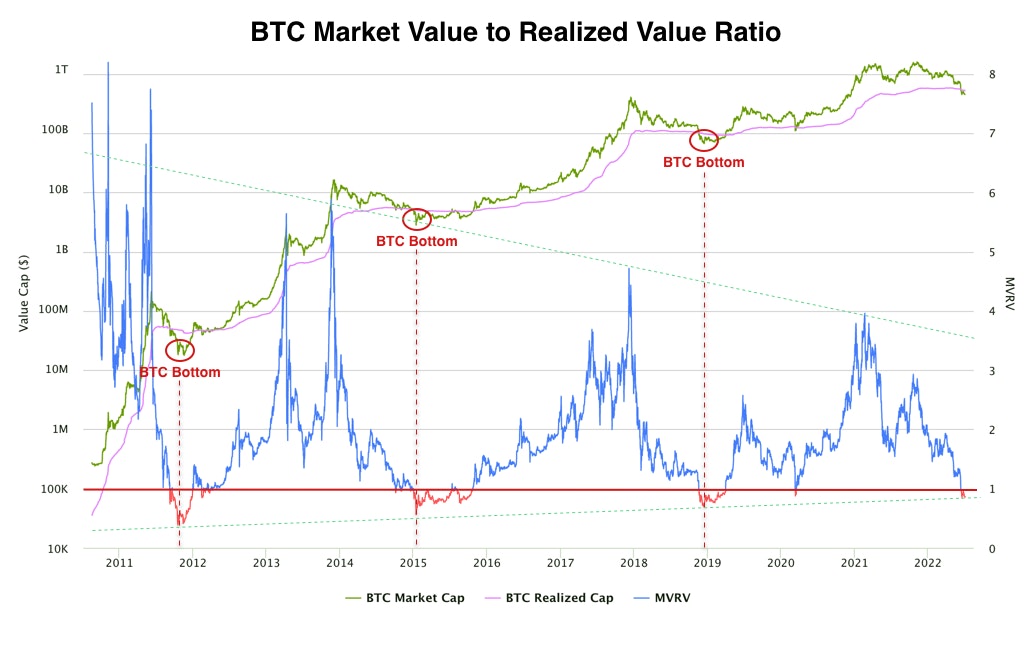

The MVRV (market-value-to-realised-value) seen as the blue line in the chart below is a ratio of Bitcoin's Market Capitalization (the green line) versus its Realised Capitalization (the pink line). The realised capitalization approximates the value paid for all coins by summing their price when they last moved on the blockchain (cost basis of supply). The MVRV ratio is used to estimate the ‘fair value’ of BTC and has just entered the undervalued territory (<1) that coincided with market bottoms in the past.

Because of the forward-looking nature of markets, BTC/USD's bottom will be in before the masses gain enough conviction to pile in. Therefore, buying these levels will always be uncomfortable.

The trillion dollar question is, what happens if, and when, all indicators signal a market bottom, but the macro outlook continues to appear dismal?

The Current State of Crypto Venture Capital

Investment into early-stage crypto projects has slowed due to current markets. The ‘spray and pray’ mentality that some funds were applying has shifted towards the methods of deeper due diligence and financial analysis of the companies issuing tokens. There has been a repricing of early-stage token valuations because many publicly trading cryptocurrencies are at 80% - 95% discounts from their all-time highs in November of last year.

Despite the change in risk appetite, great teams and founders solving critical issues and achieving product-market fit can still raise funds, as VCs are fully aware that times like these are when the true winners are built and emerge. We are seeing GameFi and Metaverse specific funds of millions, big blockchain ecosystem funds made to attract developers (Binance, Polygon, Tron, and Near), and a stronger focus on innovation.

NFTs, Games, and the onboarding of celebrities like Cristiano Ronaldo and Khaby Lane continue to spark interest in crypto from people who have never heard about Web3. We are far from reaching actual mass adoption, and investors are looking for projects to bring the next billion users into the crypto space. From an enterprise adoption perspective, there are plenty of opportunities to solve the industry's scalability, privacy, transparency, security, and onboarding issues. The market and time will tell what path crypto leads in the coming season.