For the sake of transparency towards our community, on a monthly basis we aggregate our data to give you a report on the key figures related to SwissBorg’s Smart Yield wallets.

The content of this report will be subject to change based on your feedback and the evolution of the information we receive. The report has been cleared of overwhelming graphs and a new table has replaced them.

The Smart Yield wallet simplifies and optimises earning a yield on your crypto, every single day. The goal is to find the best return for the lowest risk, while offering some of the best yielding conditions available in the market. Learn more about how Smart Yield works.

The DeFi landscape

Total value locked (TVL) in DeFi denominated in ETH reached a new all time high in January, which coincided with the lows of the wider market price action. This inversely correlated trend was identified previously, with this latest data point adding support to the thesis that investors use bearish periods in the market as an opportunity to yield, and shift to a more speculative strategy during bullish price action (as we have seen since the last week of January).

One of the alternative layer 1 solutions that surged in TVL was Fantom, jumping from $5 billion to almost $13 billion in January alone. This made it the third largest chain for a brief period, though it quickly shed much of its value and currently sits at $9 billion. This increase can be attributed to Andre Cronje’s plans for deploying a new project on Fantom called Solidly, and it included an initial period where the top 20 platforms would receive NFTs with utility for the platform. This prompted many investors to flock to the various platforms on Fantom in the hopes of taking advantage of some of the incentives planned. February will see the launch of Solidly and how its new ecosystem behaves, making room for plenty of new yield farming opportunities.

It didn’t take long for 2022 to receive its first high profile hack. On February 2nd, the Wormhole bridge which transfers assets between Ethereum and Solana was exploited for over $200 million. The exploit was unique because the exploit happened on one of the Solana smart contracts. These are largely written in Rust, whereas most exploits we have seen so far have been on EVM compatible chains with contracts written in Solidity. During the Token2049 conference last October, a major theme highlighted by one of the VC firms for 2022 was security in Rust-based smart contracts. This exploit may have kick-started this trend for the year.

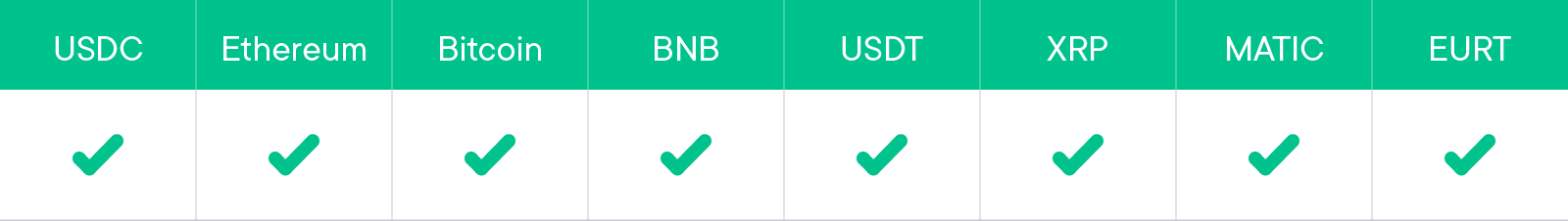

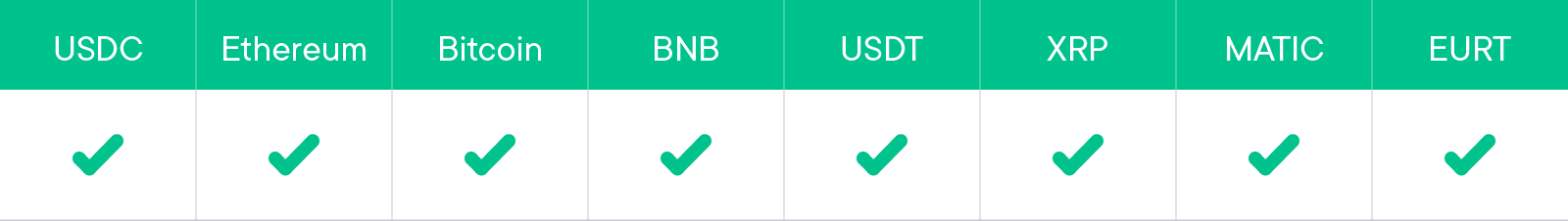

Smart Yield wallets analysis

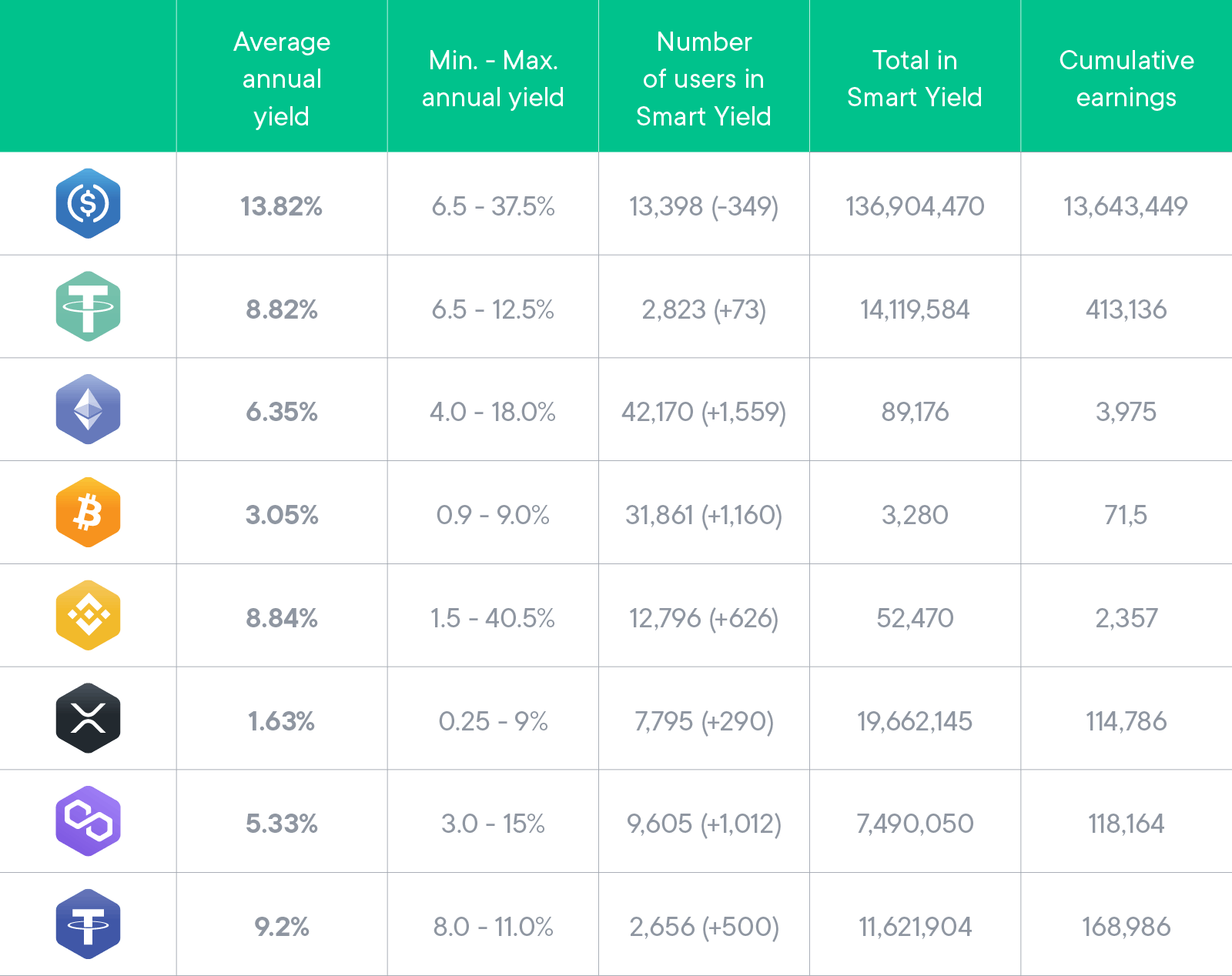

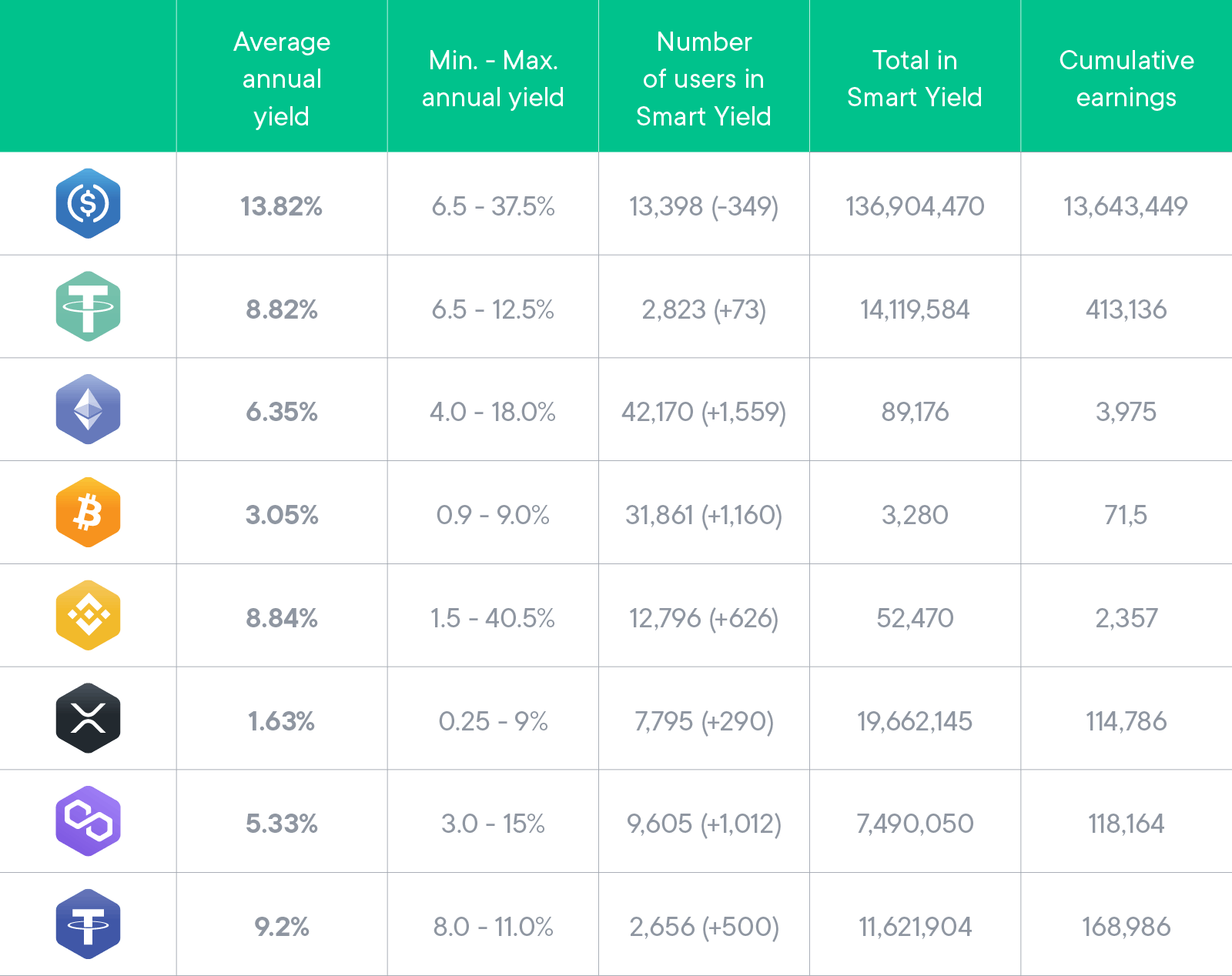

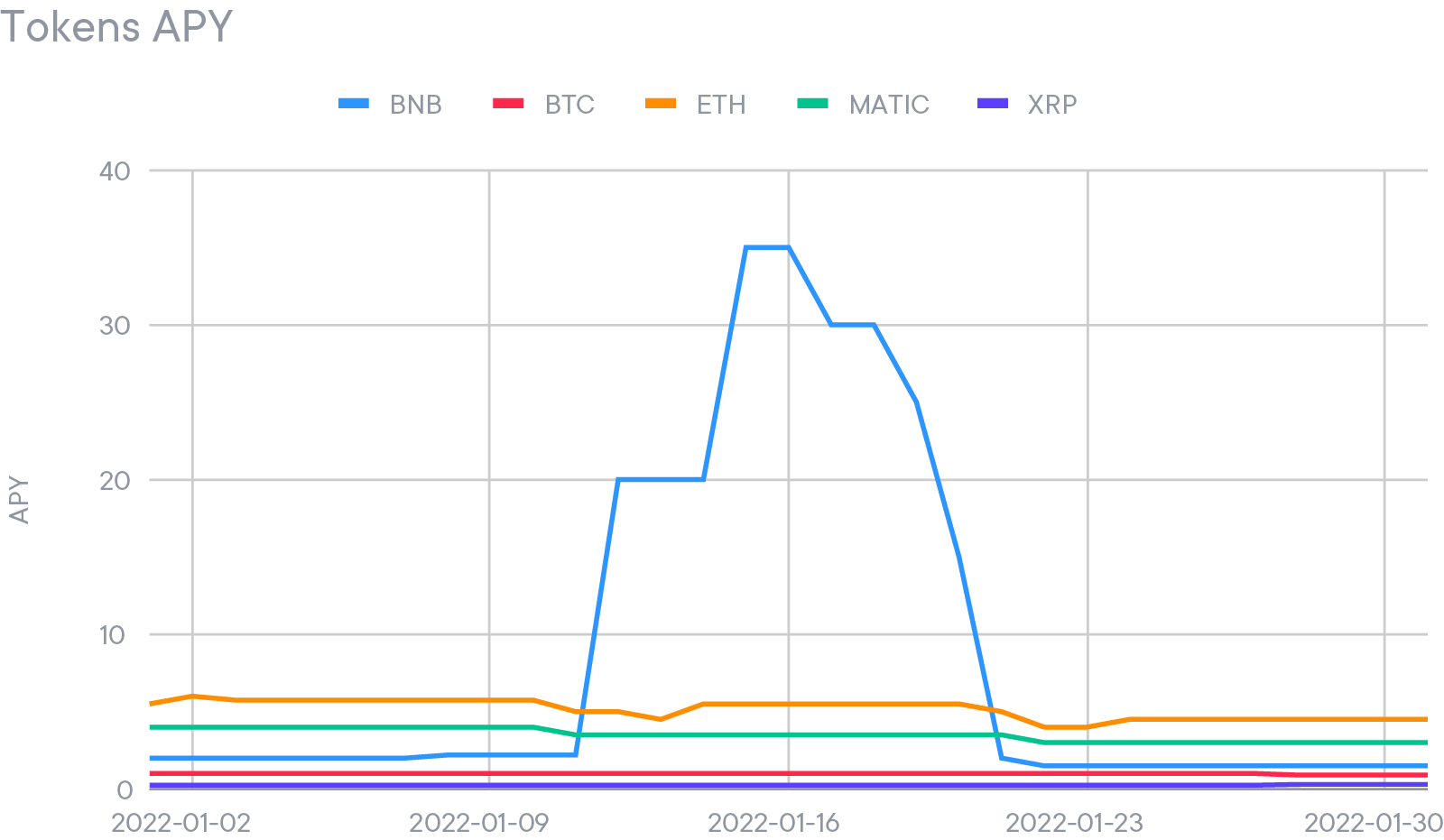

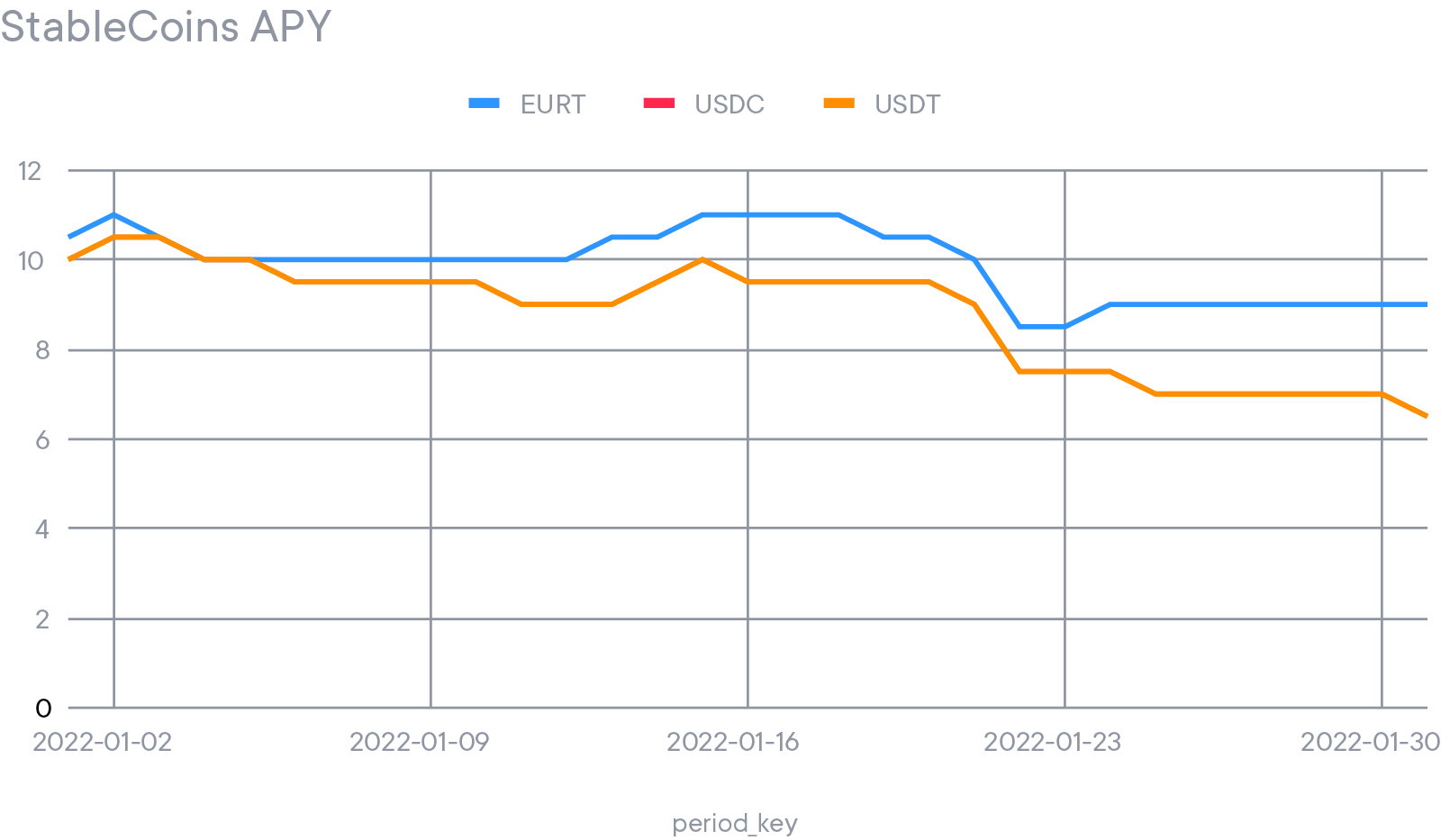

The following table summarises the wallet actions in January. It was particularly volatile with the premise of a bear market, inducing fear in traders’ behaviour. This was reflected by a reduction of the amount allocated to the Smart Yield wallets across almost all currencies, except Matic, USDT and EURT. EURT saw a lot of the traction coming from the reduction in APY from the USDC and USDT stable coins, which ended up making EURT the top yielding asset. Matic saw strong traction with more than 10% new users being the second most adopted yield wallet this month in proportion.

Despite the fact that the amount of tokens in the yield wallets fell, the number of users kept increasing, reflecting the growth of users using the SwissBorg app.

Strategy optimiser

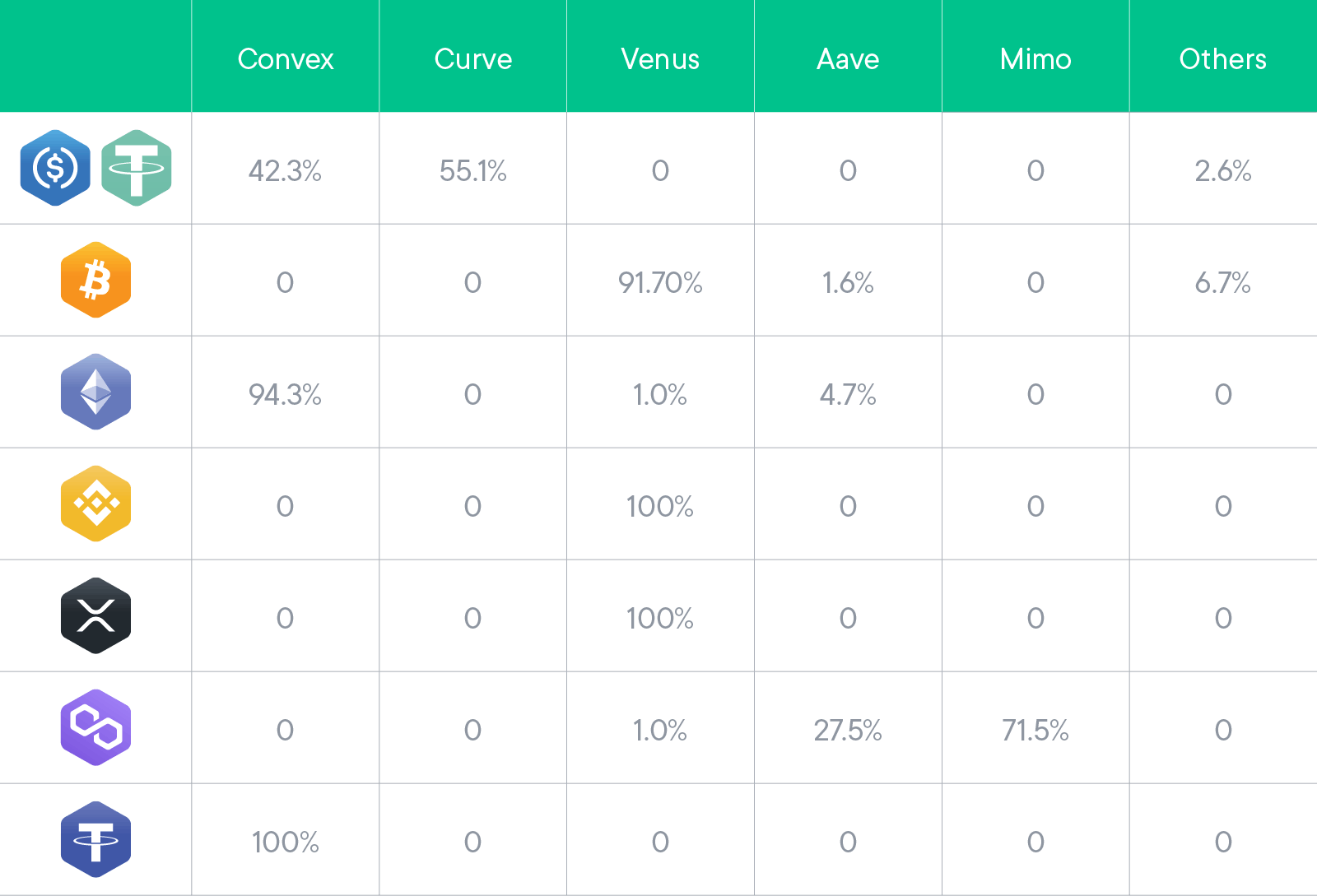

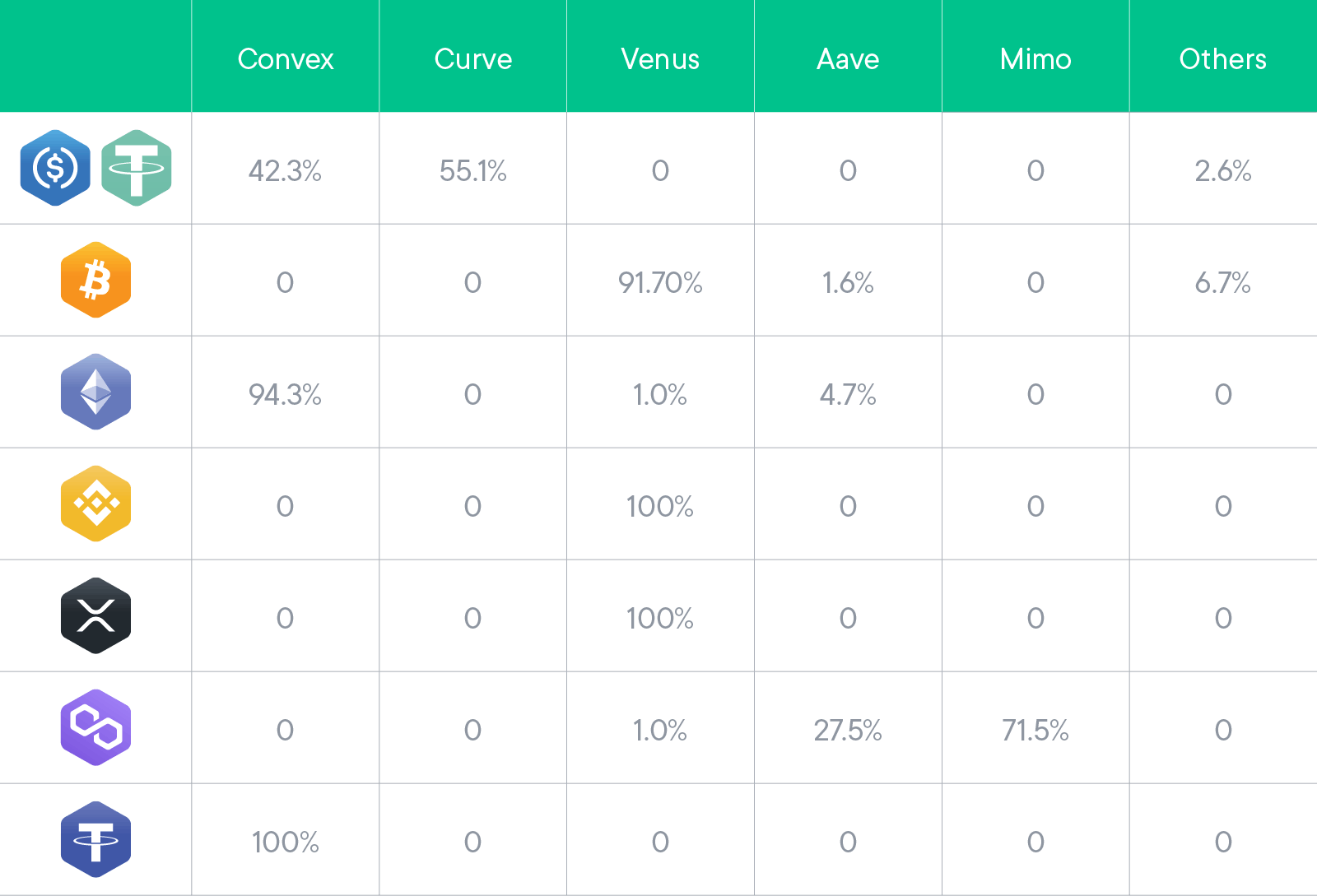

The strategy optimiser continues to allocate funds exclusively to blue-chip projects. These are:

- Aave

- Compound

- Curve/Convex

- InstaDapp

- Venus

- PancakeSwap

- MIMO

The allocation is very similar to the one in December, with Convex and Curve representing almost all the allocation of stablecoins. BTC saw a slight change of allocation with a new strategy coming on Aave.

Safety Net Program

We recall that the funding of the Safety Net has been stopped and SwissBorg is in the process of converting the funds to CHSB. The static Safety Net is still available in case it is needed, and its value will grow with the value of CHSB.

The previous 25% allocation of yield earnings to the Safety Net has been reallocated to the yields themselves, resulting in a yield boost for our users.