Staking via Kiln

Key Takeaways

- Staking represents one of the safest options in DeFi to generate yield.

- Kiln is considered a secure and trustable staking service.

- The yield (APY) is derived from staking DOT tokens – contributing to the Proof-of-Stake consensus mechanism of the Polkadot blockchain.

- Polkadot is a protocol that connects blockchains — allowing value and data to be sent across previously incompatible networks. It launched in May 2020. Polkadot implements Nominated Proof-of-Stake (NPoS), a relatively novel and sophisticated mechanism to select the validators who are allowed to participate in its consensus protocol. NPoS encourages DOT holders to participate as nominators.

- DOT liquid staking represents a liquidity yield-generating investment. No lockup period is present for this strategy but a 30-day cooldown is required to fully unstake the asset.

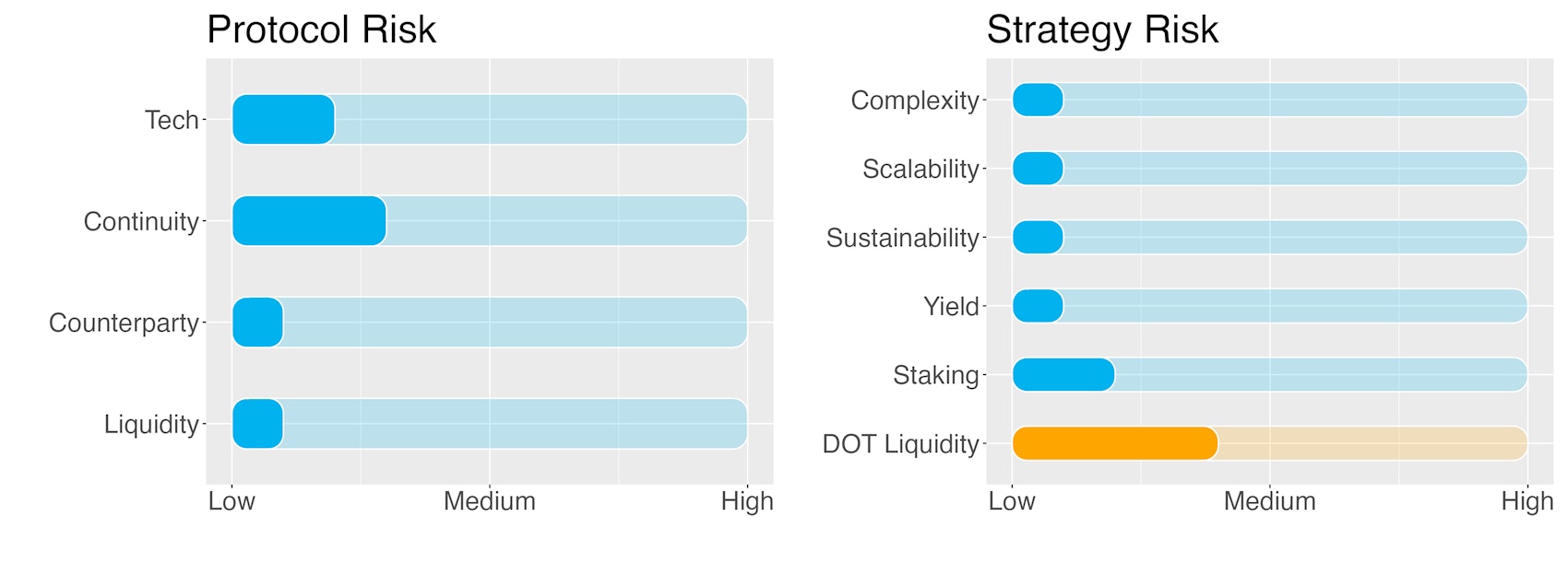

- Risk Checklist. In our view the predominant risks for this strategy are as follows: - Tech risk - Project continuity risk - Liquidity risk of staking

1. Strategy Explained

The strategy involves liquid staking DOT tokens in Kiln.

Lockup period: None.

Cooldown: 30 days

2. Risks

Trust Score

Kiln is the leading enterprise-grade staking platform, enabling institutional customers to stake assets, and to whitelabel staking functionality into their offering. The platform is API-first and enables fully automated validators, rewards, data and commission management.

SwissBorg has performed its own due diligence on the protocol and considers it trustable.

Protocol Risks

Project Continuity Risk

Project continuity risk is low.

Kiln is a Paris-based start-up that provides a service known as “staking” for blockchains.

By locking up their tokens (i.e. stake them), users join others in validating transactions on the blockchain, which protects the network from potential attack.

In November 2022 the company raised 17 million euros in a Series A funding round from a group of investors that included crypto incubator Consensys, investment firm GSR and crypto exchange Kraken's venture-capital arm. These funds have been used to expand the ‘staking-as-a-service’ offerings.

‘Staking-as-a-service’ products make it easy for custodians, exchanges, wallets and treasury managers to commit their digital assets to the blockchain. At the time of writing Kil is the 9th largest ETH staker (over 500k staked ETH).

The project is relatively new and not battle tested but given the growth of the staking practice the continuity risk should be contained.

Kiln continuity risk is set to 3/10.

Counterparty Risk

Counterparty risk is deemed low.

Counterparty risk exists whenever an asset is handed over to an external provider. Any credit events involving the staking provider could affect the assets that have been entrusted to them.

That said, staking via a 3rd party is fundamentally different from depositing funds into a lending protocol that later becomes insolvent.

In a Proof-of-Stake protocol, tokens are locked up in a validator to secure the underlying network and receive staking rewards in return.

Those validators, with the assets and rewards they hold, are fully transparent and always verifiable "on-chain". This is contrary to centralized company reserves which can be opaque and under-collateralized, as it has been seen in the case of some famous crypto exchange, now bankrupt.

With staking, there is no counterparty but the network itself. Validators are rewarded by operations automatically through preset ‘block reward’ rules, as well as through a share of transaction fees. There is no risk of default or bank runs.

Counterparty risk is 1/10.

Liquidity Risk

Liquidity risk is deemed low.

Funds held by the staking provider are redeemable after the required (if any) lockup and cooldown periods. In no circumstances would one expect instances of illiquidity during the redemption process.

Liquidity risk is 1/10.

Strategy Risks

Complexity

Complexity of the strategy is low.

The strategy involves depositing DOT on Kiln to perform staking. One chain (DOT), 1 token and one staking service is employed with no leverage.

The complexity risk of the strategy is 1/10.

Scalability

The scalability risk is low.

Staking is a highly scalable practice. Indeed, the more stakers are participating, the higher the safety of the blockchain.

The scalability risk of the strategy is 1/10.

Sustainability

The sustainability risk is low.

The yield obtained from this strategy is fully sustainable as it comes from participating in the validation of DOT transactions, the Proof-of-Stake mechanism.

Proof-of-Stake is quite energy efficient when compared to Proof-of-Work chains like Bitcoin and has therefore practically no negative impact on the environment.

The sustainability risk of the strategy is 1/10.

Yield Risk

Yield risk of strategy is low.

Staking provides a constant stream of income with low variability.

The yield risk of the strategy is 1/10.

Slashing Risk

The slashing risk of the strategy is low.

The Proof of Stake consensus mechanism requires participants to behave responsibly for the overall good of the ecosystem. For this reason, blockchains penalise validators if they step out of line by slashing the value of their stake. The two most common offences are double-signing or going offline when the validator should be available to confirm a new block.

Polkadots NPoS encourages DOT holders to participate as nominators. Nominating on Polkadot requires 2 actions: (i) Locking tokens on-chain; (ii) Selecting a set of validators, to whom these locked tokens will automatically be allocated to. Validators who produce a block are rewarded with tokens, and they can share rewards with their nominators. Both validators and nominators can stake their tokens on-chain and receive staking rewards at the end of each era.

Two risks are present when staking in Polkadot: slashing and chilling.

Slashing will happen if a validator misbehaves (e.g. goes offline, attacks the network, or runs modified software) in the network. They and their nominators will get slashed by losing a percentage of their bonded/staked DOT. Chilling is the act of stepping back from any nominating or validating. When used as part of a punishment (initiated externally), being chilled carries an implied penalty of being un-nominated.

The performance of Kiln validators can be viewed on the TurboFlakes app.

The slashing risk of the strategy is 2/10.

Liquidity Risk of Staking

Liquidity Risk on staking DOT is medium.

Staking DOT on Kiln requires no lockup but a cooldown period of 30 days. Regardless of the direction the market chooses during this time, your assets will be out of reach.

The liquidity risk is therefore set to 4/10.

3. Conclusions

DOT staking comes with little risk.

Staking per se is generally considered a very safe investment.

Kiln, the chosen liquid staking service provider, has been reviewed and approved by the SwissBorg tech team.

DOT staking comes with no lockup but a 30-day cool down period. Liquidity is therefore readily available.

The SwissBorg Risk Team ranks DOT staking as a Core investment, one for an investor with some understanding of DeFi and yielding, who is willing to take on a minimum amount of risk – while remembering that there is no free lunch! – in exchange for an acceptable reward on DOT.